How might Brexit change Britain’s brand?

FutureBrand has looked at how the UK’s brand strength might be affected in a post-Brexit climate by drawing on its “Country-brand index” and other sources.

A new piece of research shows how “brand UK” might change in the wake of Brexit.

FutureBrand has drawn on two of its own global research studies to examine the ways in which the perception of the UK as a brand might adjust now it is outside the European Union.

One study assesses country brand strength and the other explores the perceptions of the PwC top 100 global companies by market capitalisation.

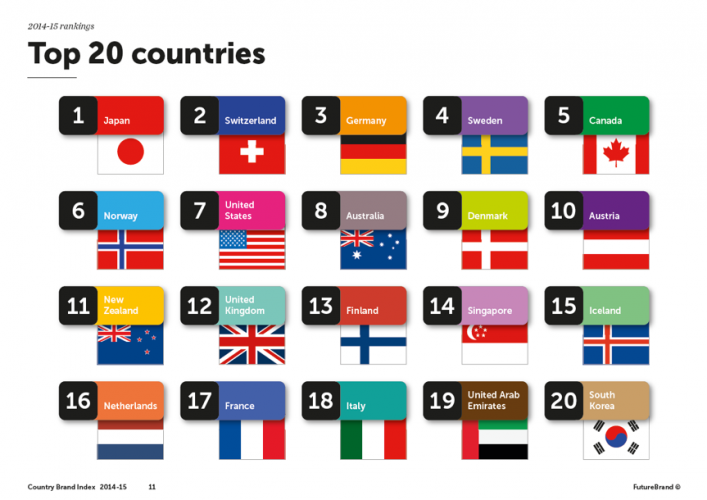

The UK’s country brand strength according to the research ranks at 12th in the list of top “country brands”. If a country scores highly as a ‘brand’ it is more likely to draw tourism and be more attractive to do business with.

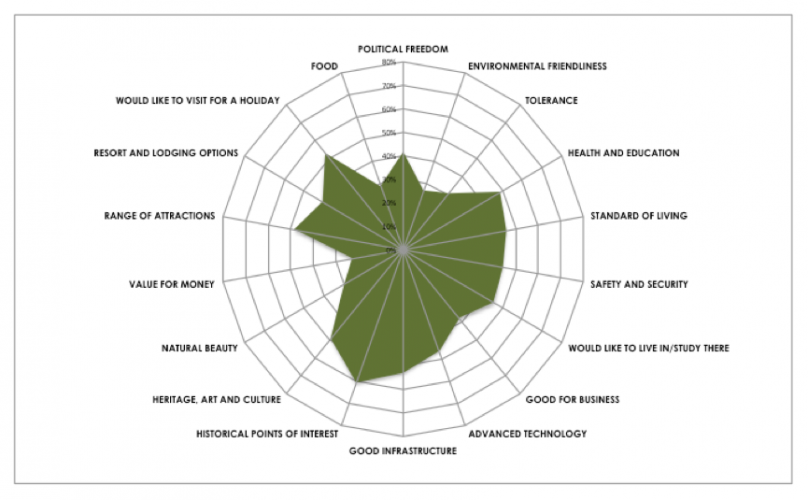

The perception of the UK varies depending on the various dimensions the study examined.

One of the UK’s weakest perception scores is in “political freedom’’. Since the UK’s electorate decided to declare its independence from the EU, this perception may start to alter.

However, one of the strongest scores the UK got was within the studies “made in” sector which assesses peoples’ perception of the quality of the goods the UK produces. Currently, the study shows that the UK ranks 9th overall for the dimension “would like to buy products made in that country.” If the decision to leave the EU does have a negative effect on demand or access to UK exports as the remain campaign claimed, this perception may start to weaken.

The research also showed that brand UK did rely on an overseas perception that it was a good place to live and study. If Brexit makes this harder or less attractive, then brand UK may be hit and its standing in relation to other ‘country brands’ will be diminished.

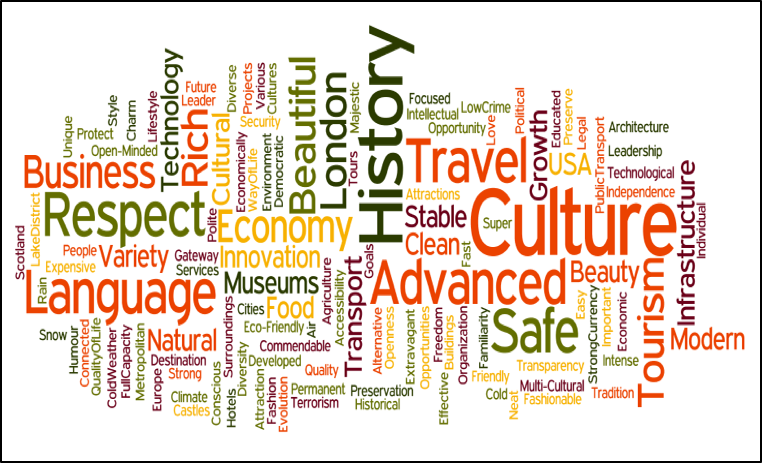

Other positive perceptions of Brand UK include its infrastructure, public services, heritage and historical points of interest. These factors do not necessarily depend on its membership of the European Union. This correlates with the fact that non-EU countries Switzerland and Norway both rank higher than most member states of the EU.

The FutureBrand Index is the second piece of research Futurebrand conducted and examines the PwC top 100 global companies. The results show the UK’s largest international companies are less likely to be seen as “moving ahead in the next three years”.

The largest UK listed companies in 2016 are Unilever, HSBC, British American Tobacco, SABMiller, BP, GlaxoSmithKline and Vodafone.

3000 people worldwide were surveyed in May and were asked: “Where do you see these companies in three years’ time?”.

The results show 49% are “moving ahead”, 37% are “standing still” and 14% are “falling behind”. These results compare to a rest of the world average of 58%, 34% and 8%.

Although FutureBrand did not ask in the survey why these perceptions are weaker they could be attributed to the uncertainty of the country’s future pre-referendum.

Now the UK has voted to leave the EU and its position outside the EU starts to become clearer these perceptions may start to strengthen again.

-

Post a comment