SomeOne helps MyJar ‘talk up’ to its customers

SomeOne has re-branded financial services company MyJar, which offers small loans to people ‘one jarful at a time’ to help them manage their money.

The consultancy won a credentials pitch at the beginning of the year to rebrand the fledgling company, which was set up in 2008 under the name TxtLoan.

MyJar allows people to borrow between £100-£500, and offers short term 18 day loans (repayable at representative 3943 per cent APR).

The naming and the visual approach are based on the company’s business model ‘designed to help people manage their money by lending small amounts responsibly’ according to SomeOne.

SomeOne co-founder David Law says, ‘I am utterly bored by almost everything branded in the financial sector. So much in the sector is just plain ugly and miserably broadcast in its monologue approach.

‘That’s why we’ve created a visual brand identity that listens to what is being said and adapts to its environment — a brand that talks up to its customers, not patronises them — which is a radical and welcome departure from the dismal industry norm.’

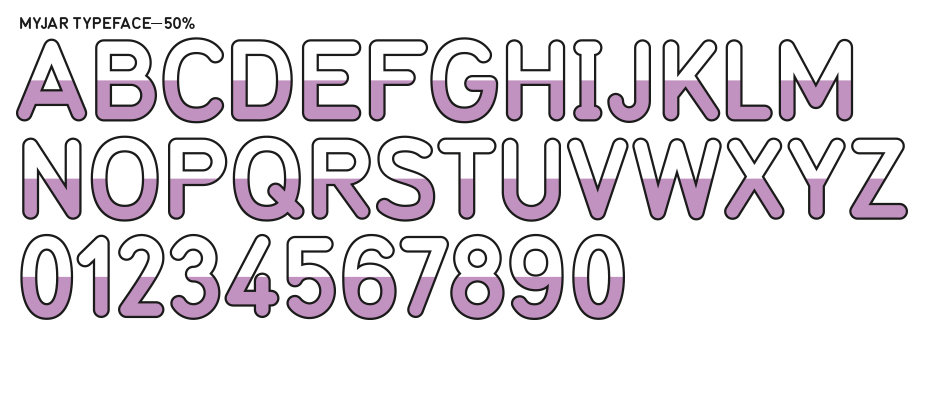

The branding is responsive and reflects the communication topic, says SomeOne, which has designed typographic jars that fill up with different amounts of colour depending on the messaging.

If the brand is talking about a small loan, a small amount of colour will be used in the hollow letterforms, but if the topic concerns larger amounts of money ‘the colour begins to flow into the chracters,’ says SomeOne.

This is not good. It looks very childish and in terms quite condescending.

This is wonderful. Such a nice focused idea and really well executed. Lovely. Hats off.

Great idea, cute branding ! I am exactky your target market and I’m a graphic designer and I clicked on the link and read the article because of the branding (though I thought it could be a jam company) still, it worked….and I dont think its condescending, I think people that need to borrow small amounts of money are intimidated by corporate branding, we tend to not be the corporate types, but more the money in a jar tyoes.

I think its great ! I am exactly your target market. I clicked on the link and read the article because of the graphics (and I’m s graphic designer). I dong think its condescending, i think people who need small loans are intimidated by corporate branding…we are not generally the corporate types but rather the money in s jar types.

“…repayable at representative 3943% APR.”

enough said.

Miles… that number might be a good headline — but it’s not the whole story… in fact. it’s not nearly as bad as that sounds as you can only borrow for a few weeks, not a year…

their www says this…

The Annual Percentage Rate is a way of showing the cost to borrow money over a full year.

However, the problem is that all types of lender have to display the APR in the same way, although lending products vary widely.

They only lend for 18 days and it is just not possible to borrow for a whole year.

Even if you are late in paying, they stop charging interest 60 days after you take the loan and we never charge interest on top of interest.

When you borrow from them they make it clear at the outset what the cost is – £20 for a £100 loan over 18 days which is the equivalent of just over 1% per day.

That’s it – that’s the simple deal.

So actually, it couldn’t be clearer on their site. Unlike their competitors.

So fairs fair… SomeOne have done a good job of making the brand clear and straightforward… it’s up to those borrowing to just pay it back on time.