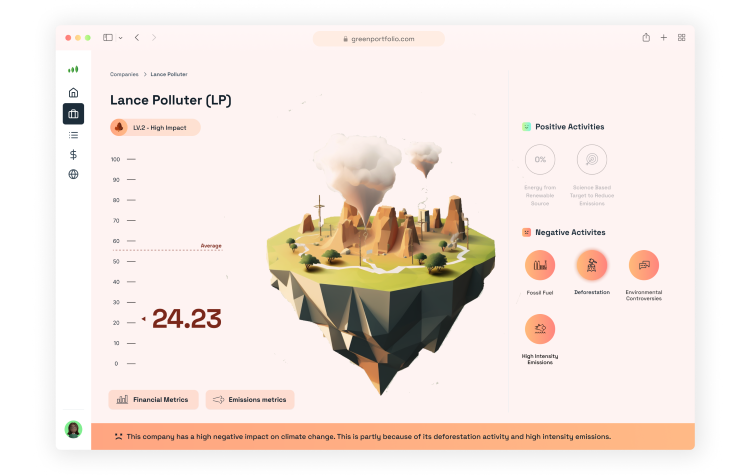

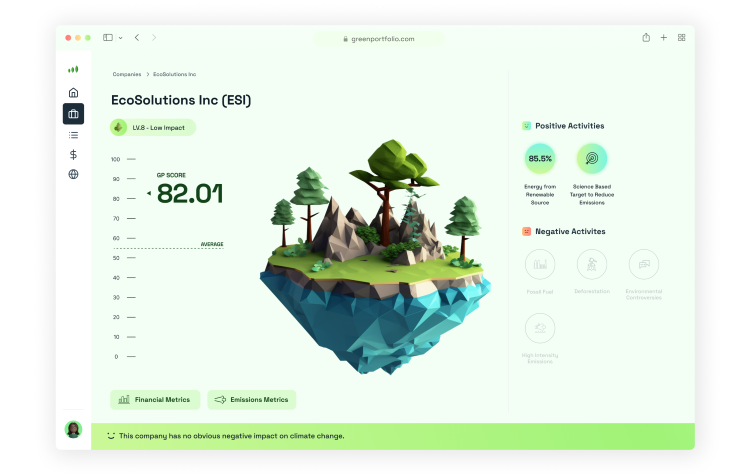

This platform uses island illustrations to show the climate impact of investments

Ustwo designed the platform using its “Play Thinking ethos”, incorporating baseball cards, illustrations and a vertical scale to make data more digestible for users.

Digital product studio Ustwo has partnered with fintech start-up GreenPortfolio to design a platform that helps users invest in climate-friendly companies with a unique scoring system.

GreenPortfolio is a SaaS (software as a service) platform that enables users to track the climate impact of their financial investments through its proprietary, climate-first scoring system. The system provides personalised portfolio analysis which was designed to help subscribers “avoid unintentionally investing in fossil fuels”, while enabling them to “easily find companies, funds and services in line with their climate values”, according to Ustwo principal client partner Zack Rosenberg.

After being connected through a mutual friend and realising there was an obvious value alignment, Ustwo began refreshing GreenPortfolio’s existing product. Ultimately, GreenPortfolio wants users to feel “engaged and hopeful” about their finances, rather than “anxious and confused”, which Rosenberg says Ustwo sought to achieve by implementing its “Play Thinking ethos”.

Play Thinking is a concept devised by Ustwo to aid the studio in “designing and building more functionally intuitive and emotionally delightful products”, says Rosenberg. He explains how it involves taking “a unique approach to product discovery, research and design”, by “beginning at the end and identifying the emotional responses [they] want to evoke from users”.

Read more: Start-up advisor True Altitude’s “psychedelic” identity

Following this, Ustwo tests the features and functionality that might facilitate these emotional outcomes, “resulting in clarity of a product’s value for users and the business and deeper engagement metrics”, Rosenberg adds.

GreenPortfolio’s 0-100 climate scoring system is a proprietary, AI-driven calculation that scores financial investments for their climate impact based on several factors, including business operations, reported emissions, and future environment commitments. User testing revealed that people responded positively to the climate score when it was color-coded, according to Rosenberg, as it made it easier to determine a company’s environmental impact.

Read more: Tyme Bank’s digital service for for the Philippines’ 51.2 million unbanked citizens

Colour-coding was implemented through illustrations, which provide “an additional, playful way to denote good and bad”, while also motivating action, says Rosenberg. Portfolios of investments with a desirable score show lush, thriving islands, while those that have a harmful environmental impact are represented as barren red and orange islands.

Rosenberg says that the idea is that when users see an island “devoid of life”, they may feel inclined to follow the platform’s “suggested alternatives for greener choices”. Although “finances are serious, and climate change even more so”, Rosenberg believes that designing through Play Thinking has allowed GreenPortfolio to “reframe the high-stakes context into something that both looks and feels friendlier and supportive”.

In a bid to make portfolio investment data even more “digestible and easy to navigate”, Ustwo incorporated subtler explanations of the implications behind metrics, such as “providing a vertical climate score” (seen on the left of the images) to help users “swifty understand the data”.

He describes one of the biggest challenges as “making the platform more interactive, rewarding, and motivating”, as it is essentially a financial data aggregator. Structuring the investment portfolio metrics as baseball cards is one example of how Ustwo implemented rewards and interactivity.

The cards were designed to make the content quick and easy to read, so that users can “understand an investment’s impact without needing to scroll”. Ultimately, this means users can look at more insights and review more investments options in a shorter amount of time.

-

Post a comment